VAT invoice issuance

Issuance of a VAT invoice for the air ticket

- Passengers declare information to receive VAT e-invoice within 72h after completing ticket and add-on service purchase.

- VAT e-invoices are only issued for payments in VND.

- Invoices cannot be split under any circumstances.

Notes: Itinerary/e-ticket receipt can be used as a VAT invoice. However, since November 1, 2020, itinerary/e-ticket receipt has not been considered a VAT invoice for reimbursement, tax deduction with tax agencies or corporates.

Instructions on VAT e-invoice issuance

A passenger get a VAT e-invoice issued in either of the following ways:

Option 1 - Visit the Declare for VAT e-invoice page

Step 1: Passengers visit the Declare for VAT e-invoice page and fill in the required information.

.png)

Step 2: Confirm the information and select the Register.

Step 3: The system confirms the successful registration; the e-invoice will be sent to the passenger's email address within 02 days from the date of registration completion.

Option 2 - Access “Manage Booking" on Vietnam Airlines’ website/mobile app

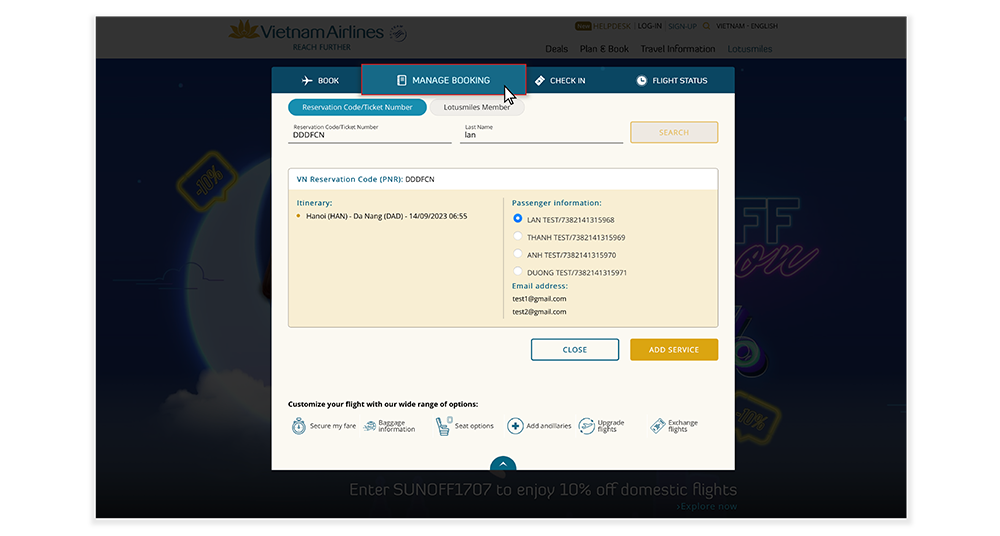

Step 1: Passengers visit Vietnam Airlines website/app, at “Manage Booking”, select tab "Reservation Code/Ticket Number", then fill Reservation Code/Ticket Number and Last Name, and click “Search”, continue select “Add Service”.

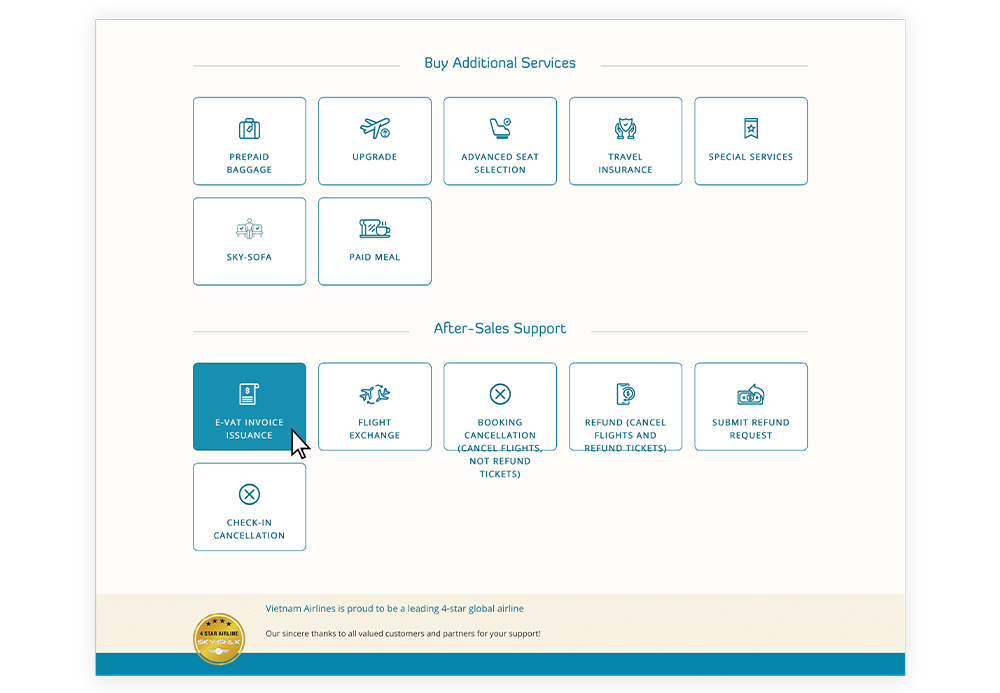

Step 2: At “Manage Booking”, passengers scroll to the “Post-sales help” and select “Invoice issuance:.

Step 3: Passengers will be redirected to the Declare for e-Invoice page. There, passengers follow the instructions as in Option 1 above.

Issuance of a VAT invoice for TripCARE Insurance

Should you require a TripCARE Travel Insurance VAT Invoice, kindly visit website https://einvoice.pvi.com.vn/hoadon to issue VAT invoice at the time of purchasing insurance. In case the request is sent after the insurance purchasing date, PVI Insurance will be unable to issue the VAT invoice for your transaction due to the lapsed deadline under current regulations.

Related Information

Are you satisfied with the information found?

What make you dissatisfied with?

What make you dissatisfied with?

What can we do to improve this?

What can we do to improve this?

What information are you looking for?

What information are you looking for?